What are SKALE Gas Fees?

Unlike Ethereum’s unpredictable gas fees, which can soar during network congestion, SKALE ensures users enjoy free, fast transactions without surprises. By leveraging sFuel—a valueless gas token—and shifting costs to developers, SKALE creates a seamless experience for dApp users while offering developers predictable budgeting and a competitive edge.

Dive into how this innovative approach could redefine blockchain accessibility and scalability in 2025.

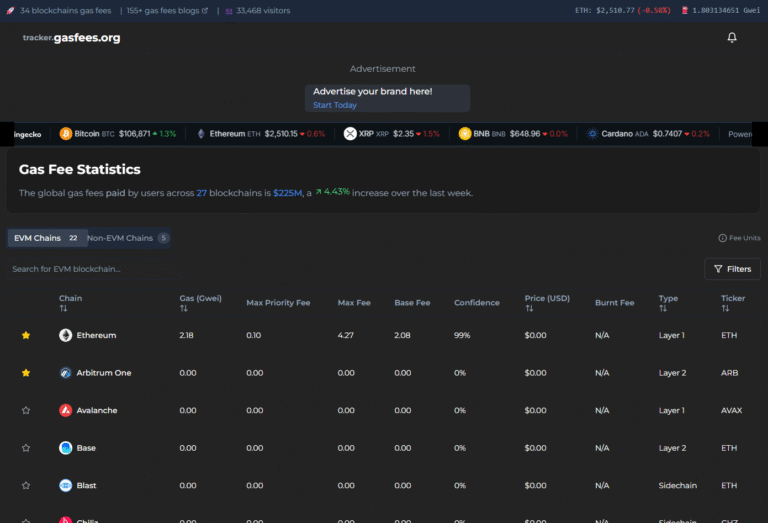

In the evolving landscape of blockchain technology, gas fees have emerged as a significant hurdle to widespread adoption, particularly on networks like Ethereum, where transaction costs can be unpredictable and high.

As of February 24, 2025, SKALE Network presents a compelling alternative with its zero gas fee model, designed to enhance user experience and scalability. This report delves into how SKALE achieves this through a subscription model, where developers pay validator nodes upfront to maintain their chains, ensuring end-users enjoy free and fast transactions without unexpected fees. We will explore the mechanics, benefits, challenges, and real-world implications, drawing from available documentation and analyses to provide a thorough understanding.

Background on Gas Fees in Blockchain

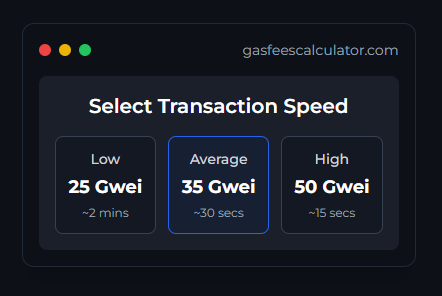

Traditional blockchain networks, such as Ethereum, rely on a gas fee model where users pay for computational resources using the network’s native token, like Ether. Gas fees serve dual purposes: incentivizing miners or validators to process transactions and preventing network spam during congestion. However, this model has drawbacks, including unpredictable costs that can deter users, especially during peak times, and user friction due to the need to manage gas tokens and estimate gas limits. For instance, Ethereum’s gas fees have been known to surge, making simple transactions costly and slowing adoption among non-technical users.

In contrast, SKALE, an Ethereum-native modular blockchain, aims to address these issues by offering zero gas fees to end-users. This is achieved through a subscription-based approach, where developers bear the cost, aligning with the network’s goal of providing a seamless, cost-free experience for users interacting with decentralized applications (dApps).

SKALE’s Subscription Model: How It Works

SKALE’s gas fee model is built on a subscription framework where developers pay validator nodes upfront to maintain their SKALE chains. This pre-payment covers the computational and operational costs, allowing users to perform transactions without any gas fees. Key components include:

- sFuel Token: SKALE utilizes a native gas token, sFuel, which has no economic or monetary value. This token is provided to chain owners (developers) upon chain creation and distributed as needed for transaction execution. Since sFuel is free for users, the cost is effectively absorbed by the developer’s subscription.

- Chain Pricing and Payments: Developers pay a subscription fee based on expected usage and computational requirements. This fee ensures validator nodes are compensated for running the chain, replacing the traditional per-transaction gas fee model. According to SKALE’s documentation (SKALE Chain Pricing), this approach was introduced to create a sustainable economic model, offering predictable costs for developers while incentivizing validators.

- Zero Gas Fees for Users: End-users benefit from free transactions, eliminating the need to acquire and manage gas tokens. This enhances user experience, particularly for those accustomed to the seamless interactions of Web2 platforms, as noted in SKALE’s blog (How Does SKALE Have Zero Gas Fees?).

Technically, each SKALE chain is run by a set of validator nodes responsible for processing transactions and maintaining the chain’s state. When a user initiates a transaction, it is executed using sFuel provided by the developer, ensuring no additional cost to the user. This model shifts the financial burden from individual users to developers, aiming to create a more accessible blockchain ecosystem.

Comparison with Traditional Models

To understand SKALE’s innovation, consider Ethereum’s gas fee model, which relies on a pay-as-you-go system. Users must estimate gas limits and pay in Ether, with fees varying based on network congestion. This can lead to high costs during peak times, as highlighted in SKALE’s blog (Gas Fees Ethereum: The Original Sin Hindering Mass Adoption), where gas fees are described as a barrier to mass adoption.

In contrast, SKALE’s model offers:

- Predictable Costs for Developers: Developers know their expenses upfront, facilitating financial planning.

- No User Costs: Users face no transaction fees, reducing friction and potentially increasing adoption.

- Scalability: SKALE’s architecture, with its AppChain network, supports high transaction throughput (up to 397,700 TPS with 1000 chains, as per SKALE’s Website), addressing scalability concerns.

However, this shift raises questions about sustainability and incentives, which we will explore later.

Benefits for Users and Developers

The zero gas fee model offers significant advantages for both users and developers, as outlined below:

For Users:

- Cost-Free Transactions: Users can interact with dApps without worrying about gas fees, making blockchain more accessible, especially for casual users or those in regions with limited cryptocurrency access.

- Improved User Experience: Eliminating gas fees removes a major pain point, aligning with Web2 expectations of seamless interactions. For example, gaming dApps can offer frictionless gameplay, as seen in case studies like a strategy game where players build empires without transaction costs (SKALE Network Documentation).

- Faster Transactions: Without the need to wait for gas price adjustments, transactions are processed more quickly, enhancing real-time applications.

For Developers:

- Predictable Costs: Subscription fees provide clarity, enabling better budgeting compared to Ethereum’s variable gas costs.

- User Attraction: Zero gas fees can attract more users, potentially increasing engagement and revenue for dApps. This is particularly beneficial for industries like gaming and DeFi, where user retention is critical.

- Customization and Scalability: Developers can tailor chains to specific needs, optimizing performance without per-transaction cost concerns, as noted in SKALE’s documentation on AppChains (SKALE Network Documentation).

Potential Challenges and Criticisms

While SKALE’s model is innovative, it is not without challenges. Critics and researchers have raised several points:

- Sustainability: Some question whether the subscription model can sustain the network as user and transaction volumes grow. If developer fees do not scale appropriately, validator nodes might be undercompensated, potentially affecting network security and performance. SKALE addresses this through a three-phase economic plan, as detailed in their blog (SKALE Chain Pricing Is Now Live On Mainnet), aiming for long-term stability.

- Centralization Risks: If only large developers can afford high-traffic chains, there might be concerns about centralization, reducing the network’s decentralization. This is a debated topic, with some Reddit discussions highlighting the need for organic community interaction to ensure broad adoption (r/SKALEnetwork on Reddit).

- Incentives for Validator Nodes: Validator nodes rely on developer subscriptions for compensation. Ensuring these fees are fair and sufficient could be complex, especially as network demand fluctuates. SKALE’s use of Proof of Stake and efficient containerization aims to optimize resource allocation, as mentioned on their website (SKALE’s Website).

These challenges are part of ongoing discussions, with SKALE’s governance mechanisms and economic design intended to mitigate them, but long-term outcomes remain to be seen.

Real-World Examples and Case Studies

SKALE’s zero gas fee model has been adopted by various projects, particularly in gaming and DeFi, where user experience is paramount. For instance:

- Gaming dApps: A strategy game allowing players to build empires and battle others has leveraged SKALE for higher transaction throughput and zero gas fees, enhancing gameplay without user costs (SKALE Network Documentation). Another example is an Ethereum-based battle game with collectible cards, which migrated to SKALE for faster commit times and cost-free transactions.

- DeFi Applications: While specific case studies are less documented, the predictable cost structure benefits DeFi projects by enabling them to offer services without passing gas fee burdens to users, potentially increasing adoption.

These examples illustrate how SKALE’s model supports diverse applications, with benefits like higher transaction throughput (up to 2000 TPS per chain, as per SKALE’s Blog)) and near-instant finality.

Comparative Analysis with Other Networks

To contextualize SKALE, consider other networks with low or zero gas fee models, such as Polygon or Arbitrum, which use Layer 2 solutions to reduce costs. However, these often still require users to pay some fees, unlike SKALE’s complete elimination for end-users. SKALE’s focus on developer-paid subscriptions sets it apart, offering a unique value proposition for both users and developers.

Conclusion

As of February 24, 2025, SKALE’s gas fee model represents a significant innovation in blockchain, addressing user friction and scalability through a developer-funded subscription system. By enabling zero gas fees for users, SKALE enhances accessibility and user experience, while providing developers with predictable costs and customization options.

While challenges like sustainability and centralization are debated, SKALE’s economic design and real-world adoption suggest a promising path forward. For those exploring blockchain solutions, SKALE offers a compelling case for cost-free, high-performance networks, potentially driving mass adoption in the Web3 era.