What Are Aptos Gas Fees?

Aptos gas fees are the costs associated with transactions on the Aptos blockchain, designed for high-speed and scalable decentralized applications. This guide explains how Aptos gas fees are calculated, what factors influence them, and how they compare to other blockchains. Learn how to manage your costs effectively while using the Aptos network.

What Are Tezos Gas Fees?

Tezos gas fees are the transaction costs required to execute operations on the Tezos blockchain, a platform known for its energy-efficient proof-of-stake consensus and on-chain governance. These fees, paid in XTZ tokens, ensure network security and efficient processing of transactions and smart contracts. Understanding Tezos gas fees is essential for optimizing costs when interacting with decentralized applications (dApps) or participating in the Tezos ecosystem.

What Are Flare Gas Fees?

Flare gas fees are the transaction costs associated with performing operations on the Flare Network, a blockchain designed to bring smart contract functionality to non-Turing complete blockchains like XRP, Litecoin, and Bitcoin. These fees, paid in FLR tokens, help secure the network and process transactions efficiently. Understanding Flare gas fees is essential for users who want to optimize costs when interacting with dApps, smart contracts, or transferring assets on the Flare network.

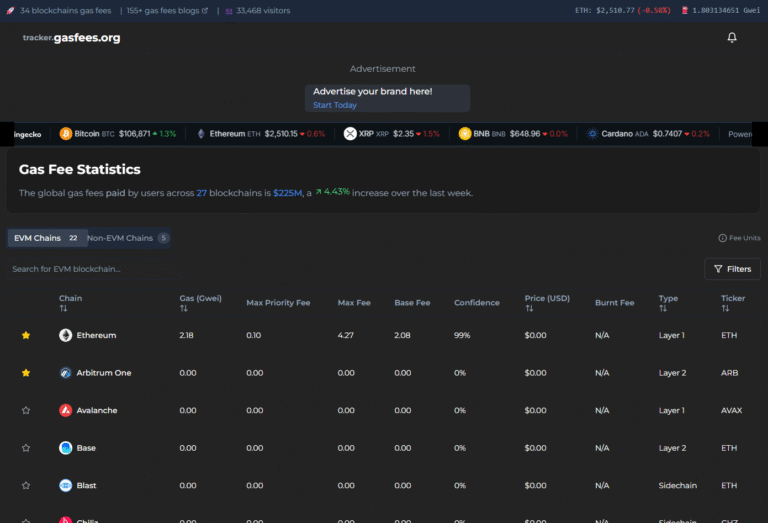

What networks are Layer 1 (L1) or Layer 2 (L2)

Layer 1 (L1) networks, like Bitcoin and Ethereum, form the base layer of blockchain technology, providing security and decentralization. Layer 2 (L2) networks, such as Polygon and Optimism, are built on top of L1s to enhance scalability and reduce transaction costs. This guide explores the key differences and popular examples of L1 and L2 networks.

What Are PulseChain Gas Fees?

PulseChain, an Ethereum fork designed for lower transaction costs, operates with its own mechanism for gas fees, similar to Ethereum but with specific adjustments. Gas fees on PulseChain are the costs users pay in the native cryptocurrency, PLS, to execute transactions, interact with smart contracts, or deploy new ones on the network.

PulseChain aims to be significantly cheaper than Ethereum, with gas fees measured in “beats,” where 1 PLS equals 1,000,000,000 beats. The gas fee structure on PulseChain is influenced by network demand, transaction complexity, and the amount of computational work required. Just like Ethereum, when the network is congested, gas fees can increase due to competition for block space.

However, PulseChain has several optimizations in place, including faster block times (10 seconds instead of Ethereum’s 12 seconds) and a higher total supply of PLS, which contribute to lower gas fees. PulseChain also implements fee burning to reduce the supply of PLS over time, potentially increasing the value of the remaining tokens.

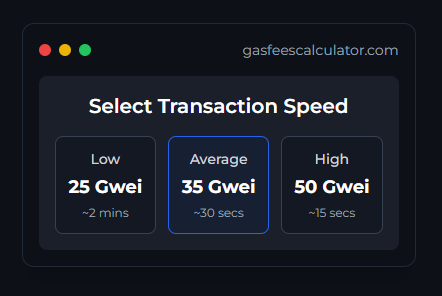

Despite these efforts, gas fees on PulseChain can fluctuate, particularly during periods of high activity like token launches or major DeFi operations. Users should check current gas price indicators or use tools like the PulseChain Gas Estimator extension to get the most up-to-date information on gas fees before executing transactions.