What Are NEAR Gas Fees?

NEAR gas fees are the transaction costs associated with executing operations on the NEAR Protocol, a high-performance blockchain designed for scalability and ease of use. These fees, paid in NEAR tokens, are typically low and predictable, enabling fast and cost-effective transactions for users and developers. Understanding NEAR gas fees helps optimize costs when interacting with decentralized applications (dApps) or deploying smart contracts on the network.

What Are Tezos Gas Fees?

Tezos gas fees are the transaction costs required to execute operations on the Tezos blockchain, a platform known for its energy-efficient proof-of-stake consensus and on-chain governance. These fees, paid in XTZ tokens, ensure network security and efficient processing of transactions and smart contracts. Understanding Tezos gas fees is essential for optimizing costs when interacting with decentralized applications (dApps) or participating in the Tezos ecosystem.

What Are Flare Gas Fees?

Flare gas fees are the transaction costs associated with performing operations on the Flare Network, a blockchain designed to bring smart contract functionality to non-Turing complete blockchains like XRP, Litecoin, and Bitcoin. These fees, paid in FLR tokens, help secure the network and process transactions efficiently. Understanding Flare gas fees is essential for users who want to optimize costs when interacting with dApps, smart contracts, or transferring assets on the Flare network.

What Are Hedera Gas Fees?

Hedera gas fees are the transaction costs required to perform operations on the Hedera Hashgraph network, known for its fast, secure, and energy-efficient consensus mechanism. These fees, paid in HBAR tokens, are fixed and predictable, making Hedera an attractive choice for developers and users of decentralized applications (dApps). Understanding Hedera gas fees helps optimize costs when transferring assets, executing smart contracts, or interacting with services on the network.

What Are Klaytn Gas Fees?

Klaytn, now part of the Kaia ecosystem, is a high-performance layer-1 blockchain designed for enterprise and DeFi applications, offering Ethereum-compatible smart contracts. Gas fees on Klaytn are the costs users pay to process transactions or execute smart contracts, calculated as Transaction Fee = Gas Used × Gas Price. Gas represents the computational resources required, while the gas price, historically fixed at 25 ston (a subunit of KLAY), now follows a dynamic pricing model based on network demand, ensuring flexibility and fairness.

For example, a simple KLAY transfer might use 21,000 gas, costing a fraction of a cent, while complex smart contract interactions, like DeFi swaps, incur higher fees. Klaytn’s low-cost structure—roughly 1/10th of Ethereum’s—makes it attractive for developers and users. Users can optimize fees by adjusting gas settings in wallets like Kaikas or using fee delegation programs, where third parties cover costs for specific DApps. Tools like Klaytn’s block explorer provide real-time fee estimates, helping users navigate this efficient, scalable network with ease.

What Are PulseChain Gas Fees?

PulseChain, an Ethereum fork designed for lower transaction costs, operates with its own mechanism for gas fees, similar to Ethereum but with specific adjustments. Gas fees on PulseChain are the costs users pay in the native cryptocurrency, PLS, to execute transactions, interact with smart contracts, or deploy new ones on the network.

PulseChain aims to be significantly cheaper than Ethereum, with gas fees measured in “beats,” where 1 PLS equals 1,000,000,000 beats. The gas fee structure on PulseChain is influenced by network demand, transaction complexity, and the amount of computational work required. Just like Ethereum, when the network is congested, gas fees can increase due to competition for block space.

However, PulseChain has several optimizations in place, including faster block times (10 seconds instead of Ethereum’s 12 seconds) and a higher total supply of PLS, which contribute to lower gas fees. PulseChain also implements fee burning to reduce the supply of PLS over time, potentially increasing the value of the remaining tokens.

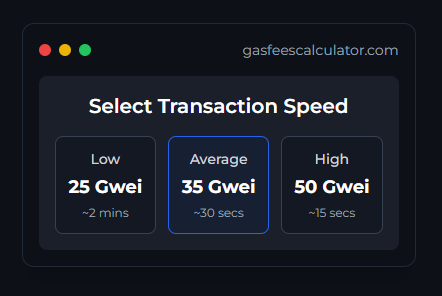

Despite these efforts, gas fees on PulseChain can fluctuate, particularly during periods of high activity like token launches or major DeFi operations. Users should check current gas price indicators or use tools like the PulseChain Gas Estimator extension to get the most up-to-date information on gas fees before executing transactions.